In an effort to lower the bidding threshold and allow buyers to focus their funds on higher-valued lots, Sotheby's officials released information on May 20

In the afternoon of May 20, Sotheby's announced a significant reduction in buyer's premiums, the most significant change to its fee structure in more than 40 years.

Effective immediately (May 20, 2024), Sotheby's has reduced buyers' fees by 26% for the vast majority of lots.

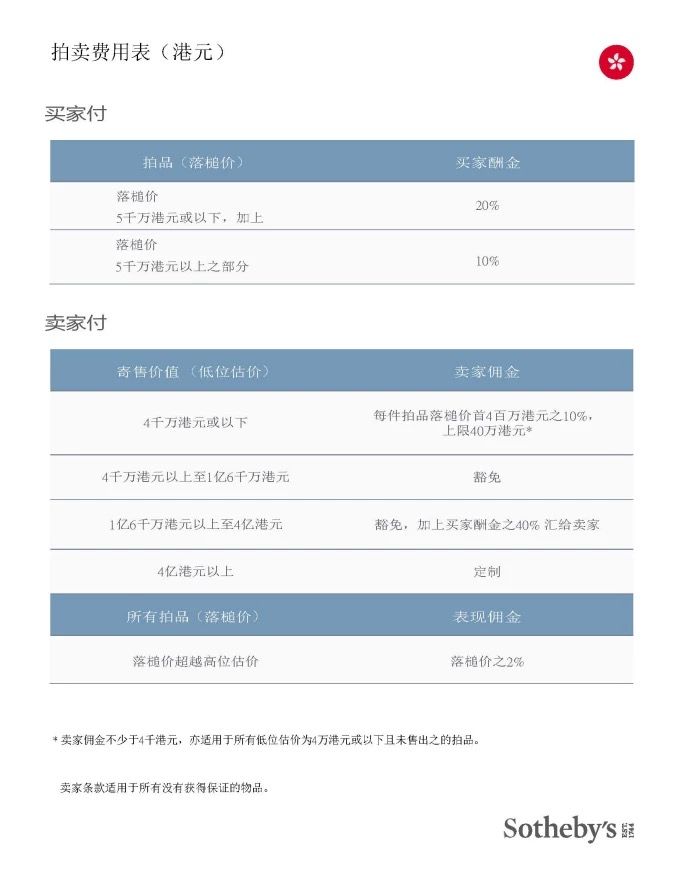

Under the new fee structure, a buyer's premium of 20% of the hammer price will be charged for lots with a hammer price not exceeding HK$50 million, while a buyer's premium of 10% of part of the hammer price for lots with a hammer price above HK$50 million will be charged.

Sotheby's is the world's largest and leading art auctioneer. The announcement of the most significant fee restructuring in more than 40 years is undoubtedly a major news for the entire art market.

This announcement will certainly generate a great deal of interest and discussion within the industry.

The significant reduction in Sotheby's buyers' fees has undoubtedly brought real benefits to investors in the art market.

Previously, high buyer's fees were often a barrier to entry, and many people were deterred from investing in their favorite works of art. Now, with lower fees, investors will have more opportunities to bid on high-value lots, which will undoubtedly increase the market's activity and competitiveness.

Lower buyer's premiums will attract more active bidding, while higher hammer prices will be equally profitable for sellers. This is great news for the industry and for all art collectors.

Of course, the lowering of buyers' fees does not mean that the threshold for artwork investment has completely disappeared.

For investors, they still need to possess a certain degree of art appreciation and market insight in order to stand out in the highly competitive market.

In addition, investors need to pay attention to factors such as the art market's policy environment, economic conditions and cultural trends in order to make informed investment decisions.

Many industry insiders said that this would help enhance the transparency and fairness of the art market, and further stimulate the potential and vitality of the market. At the same time, it will also lay a solid foundation for the long-term development of the art market, pushing it towards a more mature and stable development path.

The significant reduction in Sotheby's buyer's premiums has undoubtedly brought new development opportunities to the art market. As the market opens up further and becomes more active, we have every reason to believe that the art market will become even more prosperous and dynamic in the future.

For investors, it will also be a new era full of opportunities and challenges, requiring them to continue to learn and explore in order to grasp the pulse and trends of the market.